kiwiautotrader wrote:Hi Relativity,

I think i will have to throw away all assumptions as well - I have done such an incredible amount of backtesting (hundreds of strats, scenarios and statistical analysis) and I cant find and edge as such anywhere.

It is helpful to meet people such as yourself.

I have tryed the DTB methods / ideas before and found nothing of any real value after very conclusive testing. Thats obbiously not to say that others havnt.

On a side note, I previously left this forum out of frustration. I have never come to a forum asking for all the answer the obscure/obtuse and repetitive answers from TRO finally drove me round the bend. I believed he was here to help and guide, but I so often saw very sensible questions being asked of him and very obtuse answers being given. I began to feel like we were all pawns in his own little game.

Trust me, I felt the same initially. When I came back, I realised what TRO wants is us as new traders to take personal ownership and humble ourselves down. This is critical. It cannot be taught, but only caught.

I will admit to you that backtesting doesn't do anything : you have to forward test. This means trying the method out yourself.

Now, you said you done some forward testing for DTB. I will speak here with some qualification : it does work. In fact, its the only obvious known way to trade. Its too obvious. Buy low. Sell high. The 1st problem is, which high? Which low? TRO says D1. Its actually more than enough; its the best answer; winning traders tend to be 'found' in D1 charts or higher. At the pschyological level at least. Doesn't mean one cannot be successful at lower timeframes than D1; just that its way easier to use D1 for most good traders.

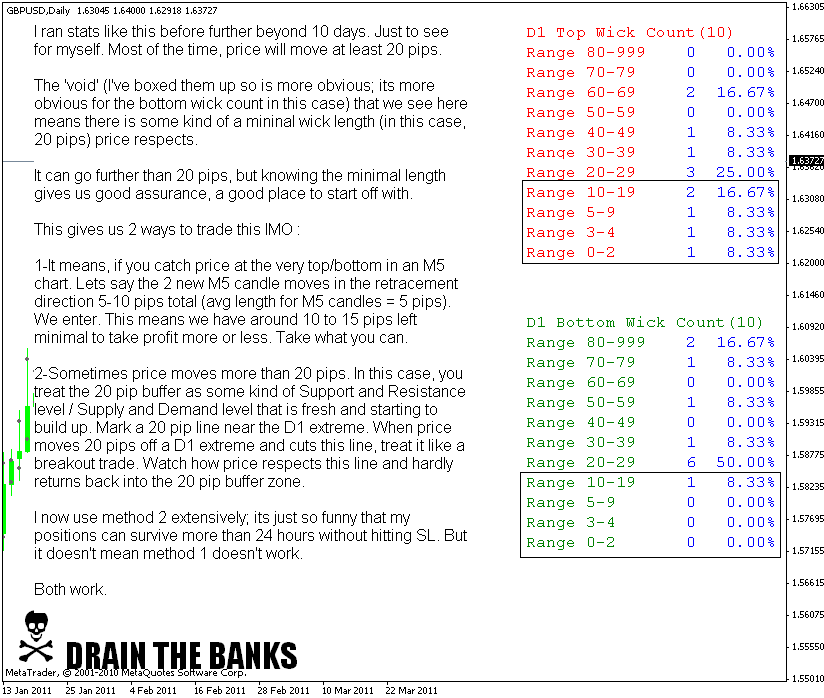

Do you have google talk or skype? I can explain it to you in better detail there. There are so many reasons why 20 pips at a D1 candle high/low just, works. Very common sense, very very simple.

kiwiautotrader wrote:Dont get me wrong, I sooo appreciate people sharing their knowledge with others - but i also feel that the good nature of others has also been taken advantage of. It must be good for the ego.

Anyway I digress - to answer some of the questions

In a nutshell my favourite method (asian breakout) worked along the lines of x range of consolidation through the asian range on a typically clean trending pair. When the breakout occurs with momentum -

I can't be bothered about others taking advantage of goodwill. These people, in the long run, lose out the most anyway. So yeah =>

Can I admit to you something? You might not like it, but when you mentioned the phase 'my favourite method', my hands got cold. As traders, we can't play favourites like that. If it doesn't work, it doesn't work. Nothing about favouritism, nor hate too. Thats what I meant by 'you are 1/2 successful'. Its quite hard for anyone to admit their 'favourite' method is not working. But please do try to let go.

Anyway, thats the emotional analysis I have for you. Now, technically, here are my questions :

1-x range of consolidation = how big? how small? time based? pip based? is it a channel? slanted? straight across? squeezing? how do you define it? do you draw 2 trendlines to determine the range of consolidation?

2-does it really have to be asian range? what is your rational?

3-momentum : what is defined as momentum here? breakout candle? volume based breakout? how much is considered momentum?

4-what if the pair is not trending cleanly? maybe look at other pairs? have you considered that the markets are interconnected, so if one pair is not trending cleanly, the chances of other pairs not doing so too are also there?

Sorry for breaking all this down, but I would like to see you to be able to see where your problems are. These problems, both emotional and technical, small or big, are hindering your progress as a trader. If no one tells you what your problems are, you will never know, unless you really think deep and reflect hard enough on your own.

I just hope I am not overly too critical on you. But please bear with me if you are willing.

kiwiautotrader wrote:I would try and trail it using a "playbook" of exit options.

Regarding your question on have I been missing out on opportunities ...Undoubtably! But I have studied/implemented and tried an ehaustive range of techniques,theories,ideas along the way.

Thanks for your help...not really sure where to go next.

Don't worry =>