Yesterday's inflation data in the US turned out to be higher than analysts expected. Thus, in general, the level of consumer prices increased by 3.7% year on year, while on a monthly basis, prices increased by 0.6%. Such data indicate that the Fed's hawkish policy has not yet produced the expected results in the fight against inflation, and, most likely, the rate will be raised again at the September meeting. However, the major currency pairs reacted rather subduedly to yesterday's fundamentals. The euro/US dollar, the pound/US dollar and the US dollar/yen managed to remain in the previously formed flat corridors.

EUR/USD

Buyers of the single European currency once again defended support at 1.0700. The development of an upward correction has not yet been observed, as investors are waiting for today's statement from the ECB. At 15:15 GMT+3, the decision on the base interest rate will be announced, and a press conference with Christine Lagarde will take place a little later. If the head of the ECB announces a possible pause in the rate hike, the pair could instantly find itself at 1.0600-1.0500. Conversely, the hawkish tone of officials could contribute to a rise to 1.1000.

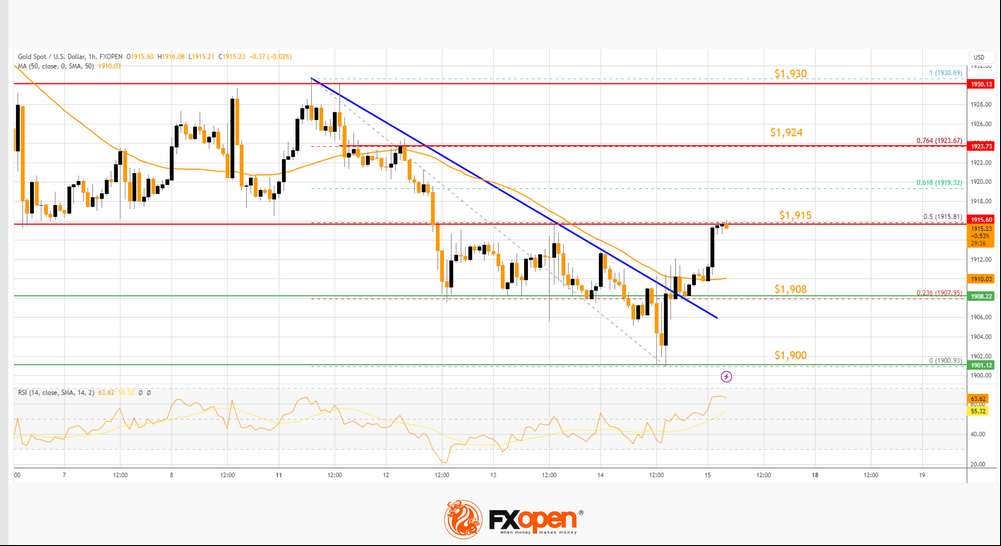

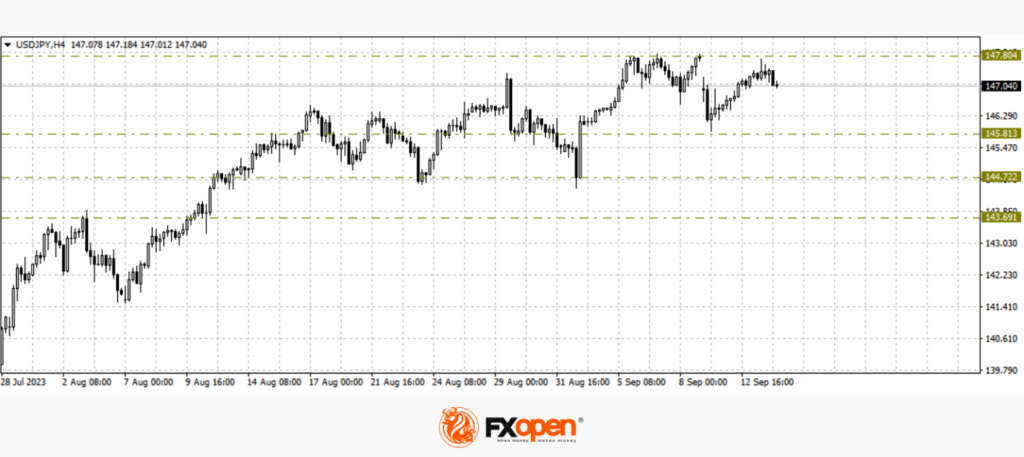

USD/JPY

Greenback buyers in the US dollar/yen pair tried yesterday to close the price gap of Monday and go above Friday’s highs of last week. The downward gap is closed, but the level of 147.80 is still confidently holding back the onslaught of dollar bulls. If the range of 147.80-148.00 remains as resistance, we may expect another approach to 146. If it goes above 148.00, we may expect continued growth in the direction of last year’s extremes at 151.00.

From the point of view of fundamental analysis, today at 15:30 GMT+3, it is worth paying attention to the publication of the US retail sales index for August. Weekly data on claims for unemployment benefits will also be released.

GBP/USD

Weak UK GDP data released yesterday resulted in the recent low at 1.2440 being updated. However, the price rebounded sharply from 1.2430 and managed to return to 1.25. The pair is still in a narrow range between 1.2440 and 1.2550; a good news driver is needed to exit flat trading.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.