EDITED: Date format was DD/MM/YY - Corrected

I'm learning Kdb+/q and I'd like to post here my steps so perhaps some traders/coders find them useful and/or interesting and we can help us each other.

Kdb+ is a column oriented database designed for massive datasets. Kdb+ includes q, a SQL-like vector processing language that can access data directly.

Kdb+ is used by financial institutions to capture, store and analyze massive amounts of time sensitive data.

I´m using the 32 bits trial software available in http://kx.com for MSWindows, Linux, Solaris and OSX.

Limitations of trial software are:

May not be used in production environments.

Times out every two hours.

Expires every two/three months.

Due to the second limitation, data should be saved often, but otherwise I found this software very interesting, compact and usable.

My target is tick backtesting TRO strategy "The Rat Adapts" as described here:

http://kreslik.com/forums/viewtopic.php?t=2904&start=0

I'm using EURUSD tickdata supplied in CSV format:

[s]MM/DD/YY hh:mm:ss,BidPrice,AskPrice[/s]

DD/MM/YY hh:mm:ss,BidPrice,AskPrice

02/01/05 18:29:14,9.99999,9.99999

First step after installing Kdb+ in the PC is starting a Kdb+/q session.

I'm using MSWindows 7 so a MSDOS window has to be opened and the active directory has to be changed to the Kdb+ folder (default C:\q)

Then to start a session type "w32\q" at the MS/DOS prompt.

A welcome message will be shown.

If there is somebody interested in this thread, please post below, and we can share ideas

Cheers

Francisco

Learning Kdb+/q

Moderator: moderators

Learning Kdb+/q

Last edited by frang0nve on Sun Jun 03, 2012 8:07 am, edited 3 times in total.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

EDITED: Date format was DD/MM/YY - Corrected

We'll select the DD/MM/YY mode:

[font=Courier New]\z 1[/font]

Then we'll import tickdata (csv format) into a q table:

[font=Courier New].Q.fs[{`EU insert flip `datetime`bidprice`askprice!("ZFF";",")0:x}]`:EU10.csv[/font]

Now with the \p command we open a http port:

[font=Courier New]\p 5001[/font]

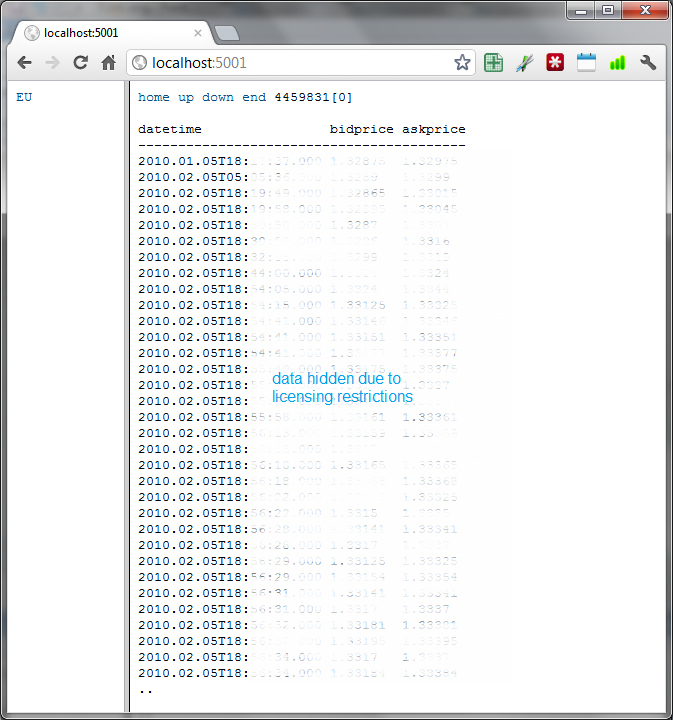

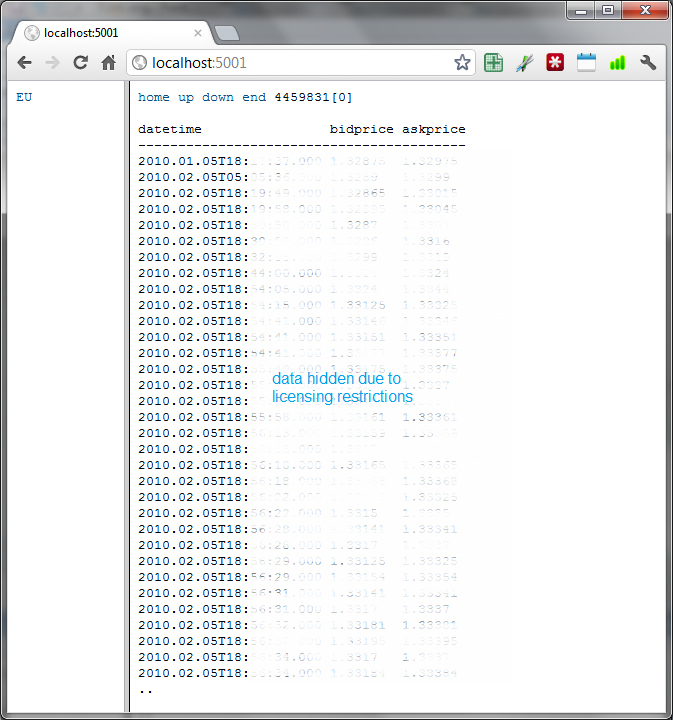

So we can see and navigate the table using a web browser:

Now we save the table in disk and close the q session:

[font=Courier New]save `:EU

\\[/font]

Cheers

We'll select the DD/MM/YY mode:

[font=Courier New]\z 1[/font]

Then we'll import tickdata (csv format) into a q table:

[font=Courier New].Q.fs[{`EU insert flip `datetime`bidprice`askprice!("ZFF";",")0:x}]`:EU10.csv[/font]

Now with the \p command we open a http port:

[font=Courier New]\p 5001[/font]

So we can see and navigate the table using a web browser:

Now we save the table in disk and close the q session:

[font=Courier New]save `:EU

\\[/font]

Cheers

Last edited by frang0nve on Tue Jun 19, 2012 3:39 am, edited 2 times in total.

After starting a new q sessión, we load the table from disk into memory and then we open a http port:

[font=Courier New]load `:EU

\p 5001[/font]

As we want to evaluate a strategy based on daily data, we extract daily information (OHLC) from tickdata:

[font=Courier New]EU_D1:select Open:first bidprice,High:max bidprice,Low:min bidprice,Close:last bidprice by 1 xbar datetime from EU[/font]

Now we save this daily table:

[font=Courier New]save `:EU_D1[/font]

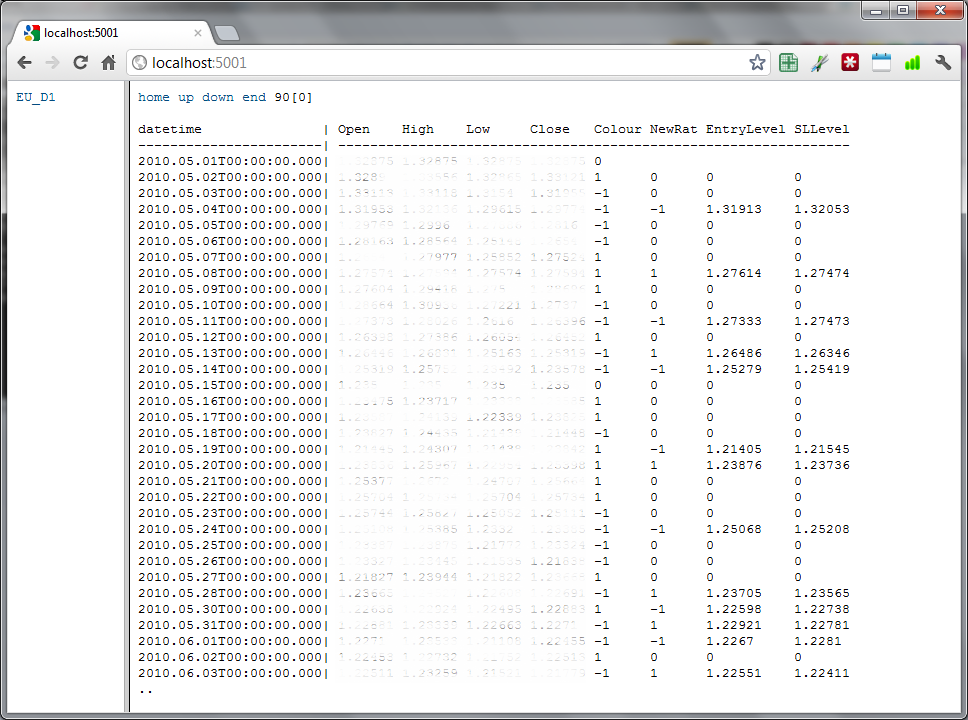

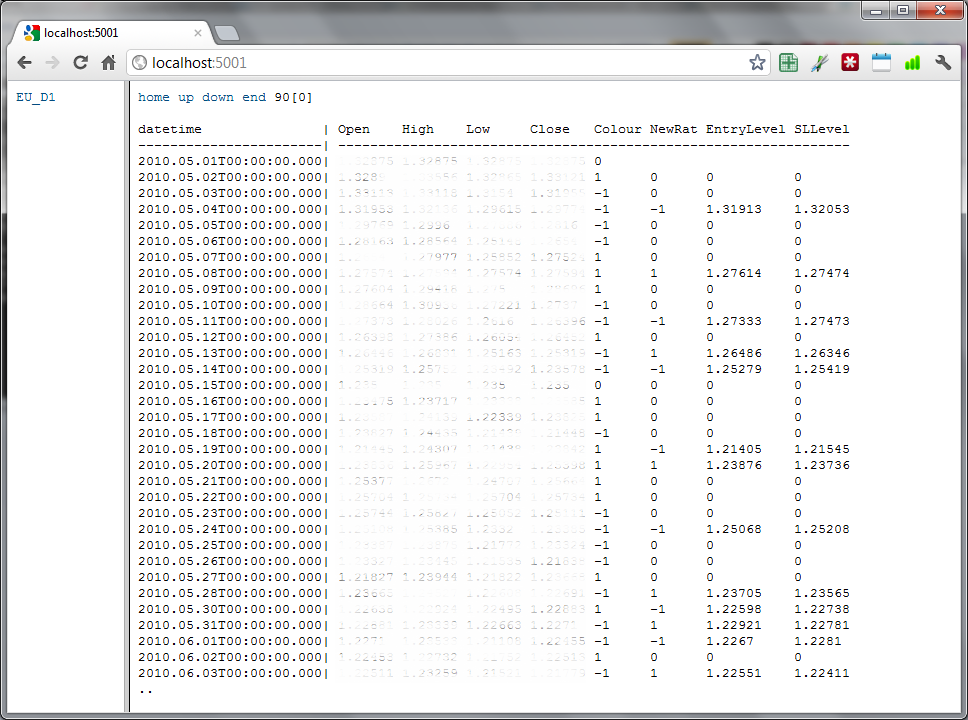

We can see the daily table using the web browser:

Cheers

[font=Courier New]load `:EU

\p 5001[/font]

As we want to evaluate a strategy based on daily data, we extract daily information (OHLC) from tickdata:

[font=Courier New]EU_D1:select Open:first bidprice,High:max bidprice,Low:min bidprice,Close:last bidprice by 1 xbar datetime from EU[/font]

Now we save this daily table:

[font=Courier New]save `:EU_D1[/font]

We can see the daily table using the web browser:

Cheers

Last edited by frang0nve on Tue Jun 19, 2012 3:46 am, edited 2 times in total.

As the strategy is based on the colour of the daily bars, we add a column with these values: 1=Green Bar, -1=Red Bar, 0= Flat Bar using this command:

EU_D1:update Colour:signum Close-Open from EU_D1

Resulting this table:

The strategy states that after a daily green bar following a red daily bar we buy at Open+4 pips and after a daily red bar following a green daily bar we sell at Open-4 pips.

So we add the column NewRat where buying days are marked 1, selling days are marked -1 and inactive days are marked 0:

EU_D1: update NewRat:prev(deltas signum Close-Open)div 2 from EU_D1

Resulting this table:

Now we save the table into disk and close the q session.

Cheers

EU_D1:update Colour:signum Close-Open from EU_D1

Resulting this table:

The strategy states that after a daily green bar following a red daily bar we buy at Open+4 pips and after a daily red bar following a green daily bar we sell at Open-4 pips.

So we add the column NewRat where buying days are marked 1, selling days are marked -1 and inactive days are marked 0:

EU_D1: update NewRat:prev(deltas signum Close-Open)div 2 from EU_D1

Resulting this table:

Now we save the table into disk and close the q session.

Cheers

Last edited by frang0nve on Mon Jun 04, 2012 2:49 am, edited 1 time in total.

UPDATED: Bug calculating SLLevel-> Command corrected

After opening the q session, the http port and loading the daily data table, we'll add a column to the table with the daily entry level (Open+4 pips when buying, Open-4 pips when shorting) and the Stop Loss level (10 pips):

[font=Courier New]Threshold:0.0004

StopLoss:0.001

[s]EU_D1:update EntryLevel:(abs NewRat)*Open+Threshold*NewRat,SLLevel:(abs NewRat)*Open-StopLoss*NewRat from EU_D1[/s]

EU_D1:update EntryLevel:(abs NewRat)*Open+Threshold*NewRat,SLLevel:EntryLevel-StopLoss*NewRat from EU_D1[/font]

Here is the updated table:

We can save the table and close the q session

Cheers

After opening the q session, the http port and loading the daily data table, we'll add a column to the table with the daily entry level (Open+4 pips when buying, Open-4 pips when shorting) and the Stop Loss level (10 pips):

[font=Courier New]Threshold:0.0004

StopLoss:0.001

[s]EU_D1:update EntryLevel:(abs NewRat)*Open+Threshold*NewRat,SLLevel:(abs NewRat)*Open-StopLoss*NewRat from EU_D1[/s]

EU_D1:update EntryLevel:(abs NewRat)*Open+Threshold*NewRat,SLLevel:EntryLevel-StopLoss*NewRat from EU_D1[/font]

Here is the updated table:

We can save the table and close the q session

Cheers

Last edited by frang0nve on Tue Jun 19, 2012 6:52 am, edited 4 times in total.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

Now things become trickier, as the take profit description for this strategy is: "Take whatever profit you can"

That can be achieved using an exits playbook like this:

SL is moved forward:

If profit = 5 pips move SL to entry level+3 pips

If profit = 10 pips move SL to entry level+5 pips

If profit = 15 pips move SL to entry level+10 pips

If profit >= 20 pips SL moves to entry level+0.5*max profit

I'm thinking how to code these rules in q.

Cheers

That can be achieved using an exits playbook like this:

SL is moved forward:

If profit = 5 pips move SL to entry level+3 pips

If profit = 10 pips move SL to entry level+5 pips

If profit = 15 pips move SL to entry level+10 pips

If profit >= 20 pips SL moves to entry level+0.5*max profit

I'm thinking how to code these rules in q.

Cheers

There is another rule in the strategy using weekly data:

I'll select saturday as first day in the week (my broker allows 7 days/week trading) using the \W 0 command:

The week offset command \W (note upper case) specifies the start of week offset. An offset of 0 corresponds to Saturday. The default is 2, which is Monday.

To use weekly open we extract the information from tick data table EU:

EU_W1:select Open:first bidprice by 7 xbar datetime from EU

And now we can see the table in the web browser:

We can save the table to disk using the command:

save `:EU_W1

Cheers

The RAT only goes LONG when price is ABOVE the weekly open and only goes SHORT when price is BELOW the weekly open.

I'll select saturday as first day in the week (my broker allows 7 days/week trading) using the \W 0 command:

The week offset command \W (note upper case) specifies the start of week offset. An offset of 0 corresponds to Saturday. The default is 2, which is Monday.

To use weekly open we extract the information from tick data table EU:

EU_W1:select Open:first bidprice by 7 xbar datetime from EU

And now we can see the table in the web browser:

We can save the table to disk using the command:

save `:EU_W1

Cheers

Last edited by frang0nve on Thu Jun 14, 2012 4:02 am, edited 1 time in total.

-

harryjeesu

- rank: <50 posts

- Posts: 2

- Joined: Mon Jun 04, 2012 12:58 pm

- Reputation: 0

- Location: Pune

- Gender:

Basic data structure

atoms:

q)sym: `ibm

List:

q)price: 10.2 30.0 40.4

q)syms:`ibm`msft`goog

q)volume: 1200 1100 2312

q)(syms;price;volume)

ibm msft goog

10 30 40

1200 1100 2312

dictionary:

q)dict:`syms`price`volume!(syms;price;volume) /dictionary

q)dict

syms | ibm msft goog

price | 10 30 40

volume| 1200 1100 2312

table:

q)table: flip dict

q)table

syms price volume

-----------------

ibm 10 1200

msft 30 1100

goog 40 2312

converting into key table:

q)1!table

syms| price volume

----| ------------

ibm | 10 1200

msft| 30 1100

goog| 40 2312

q)2!table

syms price| volume

----------| ------

ibm 10 | 1200

msft 30 | 1100

goog 40 | 2312

q)sym: `ibm

List:

q)price: 10.2 30.0 40.4

q)syms:`ibm`msft`goog

q)volume: 1200 1100 2312

q)(syms;price;volume)

ibm msft goog

10 30 40

1200 1100 2312

dictionary:

q)dict:`syms`price`volume!(syms;price;volume) /dictionary

q)dict

syms | ibm msft goog

price | 10 30 40

volume| 1200 1100 2312

table:

q)table: flip dict

q)table

syms price volume

-----------------

ibm 10 1200

msft 30 1100

goog 40 2312

converting into key table:

q)1!table

syms| price volume

----| ------------

ibm | 10 1200

msft| 30 1100

goog| 40 2312

q)2!table

syms price| volume

----------| ------

ibm 10 | 1200

msft 30 | 1100

goog 40 | 2312

-

harryjeesu

- rank: <50 posts

- Posts: 2

- Joined: Mon Jun 04, 2012 12:58 pm

- Reputation: 0

- Location: Pune

- Gender:

Ways to inserting data into q table:

Creating a table:

q)trade : ([]sym: (); price: (); volume: `int$())

show table

q)trade

sym price volume

----------------

Ways to insert data into tables:

q)insert[`trade](`aaa;53.75;1200)

,0 --------> / row added i.e first row

q)trade

sym price volume

----------------

aaa 53.75 1200

q)insert[`trade;(`bbb;10.45;1000)]

,1 ----------> row added i.e. second row

q)show trade

sym price volume

----------------

aaa 53.75 1200

bbb 10.45 1000

q)`trade insert(`ccc;59.50;1000)

,2 ----------> row added i.e 3rd row

q)trade

sym price volume

----------------

aaa 53.75 1200

bbb 10.45 1000

ccc 59.5 1000

bulk insertion:

q)stock: `aaa`bbb`ccc`ddd`eee`fff`ggg`hhh`iii`jjj`kkk`lll`mmm

q)n: 20

q)trade:([]sym: n?stock;price: n?50.0; volume: 100*10+n?10)

q)trade

sym price volume

--------------------

hhh 4.061773 1800

iii 46.83752 1100

fff 13.91061 1900

ggg 11.96171 1500

kkk 7.540665 1400

eee 7.836585 1600

mmm 48.925 1600

bbb 35.21657 1100

mmm 47.20835 1800

ddd 39.16843 1500

ddd 20.49781 1400

hhh 30.54409 1900

iii 24.88246 1200

ccc 20.43772 1700

bbb 22.48655 1000

eee 0.6960381 1100

ccc 35.7439 1900

iii 9.732546 1200

aaa 4.529513 1100

mmm 31.01507 1800

Converting a table into key table:

q)1 !trade

sym| price volume

---| ----------------

hhh| 4.061773 1800

iii| 46.83752 1100

fff| 13.91061 1900

ggg| 11.96171 1500

kkk| 7.540665 1400

eee| 7.836585 1600

mmm| 48.925 1600

bbb| 35.21657 1100

mmm| 47.20835 1800

ddd| 39.16843 1500

ddd| 20.49781 1400

hhh| 30.54409 1900

iii| 24.88246 1200

ccc| 20.43772 1700

bbb| 22.48655 1000

eee| 0.6960381 1100

ccc| 35.7439 1900

iii| 9.732546 1200

aaa| 4.529513 1100

mmm| 31.01507 1800

q)trade : ([]sym: (); price: (); volume: `int$())

show table

q)trade

sym price volume

----------------

Ways to insert data into tables:

q)insert[`trade](`aaa;53.75;1200)

,0 --------> / row added i.e first row

q)trade

sym price volume

----------------

aaa 53.75 1200

q)insert[`trade;(`bbb;10.45;1000)]

,1 ----------> row added i.e. second row

q)show trade

sym price volume

----------------

aaa 53.75 1200

bbb 10.45 1000

q)`trade insert(`ccc;59.50;1000)

,2 ----------> row added i.e 3rd row

q)trade

sym price volume

----------------

aaa 53.75 1200

bbb 10.45 1000

ccc 59.5 1000

bulk insertion:

q)stock: `aaa`bbb`ccc`ddd`eee`fff`ggg`hhh`iii`jjj`kkk`lll`mmm

q)n: 20

q)trade:([]sym: n?stock;price: n?50.0; volume: 100*10+n?10)

q)trade

sym price volume

--------------------

hhh 4.061773 1800

iii 46.83752 1100

fff 13.91061 1900

ggg 11.96171 1500

kkk 7.540665 1400

eee 7.836585 1600

mmm 48.925 1600

bbb 35.21657 1100

mmm 47.20835 1800

ddd 39.16843 1500

ddd 20.49781 1400

hhh 30.54409 1900

iii 24.88246 1200

ccc 20.43772 1700

bbb 22.48655 1000

eee 0.6960381 1100

ccc 35.7439 1900

iii 9.732546 1200

aaa 4.529513 1100

mmm 31.01507 1800

Converting a table into key table:

q)1 !trade

sym| price volume

---| ----------------

hhh| 4.061773 1800

iii| 46.83752 1100

fff| 13.91061 1900

ggg| 11.96171 1500

kkk| 7.540665 1400

eee| 7.836585 1600

mmm| 48.925 1600

bbb| 35.21657 1100

mmm| 47.20835 1800

ddd| 39.16843 1500

ddd| 20.49781 1400

hhh| 30.54409 1900

iii| 24.88246 1200

ccc| 20.43772 1700

bbb| 22.48655 1000

eee| 0.6960381 1100

ccc| 35.7439 1900

iii| 9.732546 1200

aaa| 4.529513 1100

mmm| 31.01507 1800

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.