TygerKrane's Pip-Pickpocketing

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

My Most Embarrasing Post Ever

Before you look even further, just know that this is my Most Embarrassing Post Ever, I am absolutely ashamed to put it up, but I kind of have to. Soo embarrassing, it happened Tuesday afternoon/evening, and I was just like "f#ck it, I'm taking the rest of the week off", and it has taken me several says till now to just get the guts to post it up and share.

Of course, I take a break from trading, and the f-ing US market has its biggest one-day drop since 2008, and apparently lost a value almost equivalent to the size of France's entire economy.

I also can't believe gold spiked up to $1680/oz on the the US Markets dropped; that and seeing US get it's S&P credit rating cut, wow.

Only a slightly unrelated note, I don't think I mentioned that I've pretty much completely stopped listening to news, I'm hoping that I could approach what I see in the charts with an open mind if I'm not aware or biased by the headlines I hear in the news. I just want to try and react to charts and nothing else.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

So basically, (in my previous post) I tried to make a decent assessment of what I thought might happen on the EA. That was 11AM EST.

About 3PM EST I look at the charts, I see that price hadn't moved too far since the last time, so,

So despite my previous Long analysis in the previous post, I figured 5PM EST should give birth to a countertrend at some point before continuing long. So I Shorted...then Shorted desperately; then at about -8% P/L, I put in a Stop Order and just shut off the trading station and knew I needed a few days off to get my head back on straight. Luckily, I hadn't put the bigger money into my account yet, so no need to go home and kick any puppies.

Most of the short entries I took had nothing to do with PA logic on smaller timeframes; they were just guided by those 'observations' I listed above.

I still live to trade another day tho.

Of course, I take a break from trading, and the f-ing US market has its biggest one-day drop since 2008, and apparently lost a value almost equivalent to the size of France's entire economy.

I also can't believe gold spiked up to $1680/oz on the the US Markets dropped; that and seeing US get it's S&P credit rating cut, wow.

Only a slightly unrelated note, I don't think I mentioned that I've pretty much completely stopped listening to news, I'm hoping that I could approach what I see in the charts with an open mind if I'm not aware or biased by the headlines I hear in the news. I just want to try and react to charts and nothing else.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

So basically, (in my previous post) I tried to make a decent assessment of what I thought might happen on the EA. That was 11AM EST.

About 3PM EST I look at the charts, I see that price hadn't moved too far since the last time, so,

- I notice the yellow circled area and think to myself, "This must be an area of consolidation/resistance

- It's pretty much the end of active trading and we've already had 6 Consecutive H3 Candles, so at this time of day with a lower trading volume, price pretty much HAS TO bounce off that previous consolidation and go short for a bit. (i.e. the consecutive candles couldn't start from so far back and then continue even through the inactive period.)

- Price WOULD HAVE TO give me a decent short from the circled consolidation area before it would attempt to hit that Short H3 MOMO origin at 1.3250

- So yes, even as price had went Long beyond the consolidation, there WOULD HAVE TO BE a decent short before it went to 1.3250

So despite my previous Long analysis in the previous post, I figured 5PM EST should give birth to a countertrend at some point before continuing long. So I Shorted...then Shorted desperately; then at about -8% P/L, I put in a Stop Order and just shut off the trading station and knew I needed a few days off to get my head back on straight. Luckily, I hadn't put the bigger money into my account yet, so no need to go home and kick any puppies.

Most of the short entries I took had nothing to do with PA logic on smaller timeframes; they were just guided by those 'observations' I listed above.

I still live to trade another day tho.

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

Body in the direction of profit, wick in the direction of loss; if price has been closing higher then what makes you think that it will close lower?

If you have to look beyond center screen for price action then you are better off moving to a higher chart.

Price doesn't "have to" do anything, but it is likely that a range will expand in the direction where price closed over "something"

If you can master basic ideas...

use position size instead of stops...

& build a position in the direction of the expansion...

then you just might have a fighting chance.

If you have to look beyond center screen for price action then you are better off moving to a higher chart.

Price doesn't "have to" do anything, but it is likely that a range will expand in the direction where price closed over "something"

If you can master basic ideas...

use position size instead of stops...

& build a position in the direction of the expansion...

then you just might have a fighting chance.

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

[highlight=darkred][font=lucida console]Body in the direction of profit, wick in the direction of loss; if price has been closing higher then what makes you think that it will close lower?[/font][/highlight]

[align=center] [/align]

[/align]

[align=center]hmmmmmm,

[/align]

[/align]

<Anyways, I thought that sounded familiar....>

[highlight=darkred][font=lucida console]If you have to look beyond center screen for price action then you are better off moving to a higher chart.[/font][/highlight]

H3, H6, H8, D1:

Thanks for the thoughts, MO

[align=center]

[/align]

[/align]

[align=center]hmmmmmm,

[/align]

[/align]

<Anyways, I thought that sounded familiar....>

MightyOne

wrote:

TygerKrane wrote:[font=Verdana][highlight=violet]I Truly Have an Addiction to Reversals:[/highlight][/font]

Honestly. When I turn on my trading station it is the first thing I look for [reversals to go long, reversals to go short], and sometimes, unfortunately, I miss a hell of a lot b/c I miss seeing that continuations are part of the game as well.

There is a saying that goes something like, "If all you have is a Hammer, then the whole world begins to look like a Nail to you." I don't know if I can use that to actually help me...but it definitely seems fitting of my current mental situation, I say.

In the back of my mind, I am conjuring up ways in which the H4 can help me from getting whipped & battered in situations like this. (I guess there is also always the Zline basics that I can reconsider as well.)

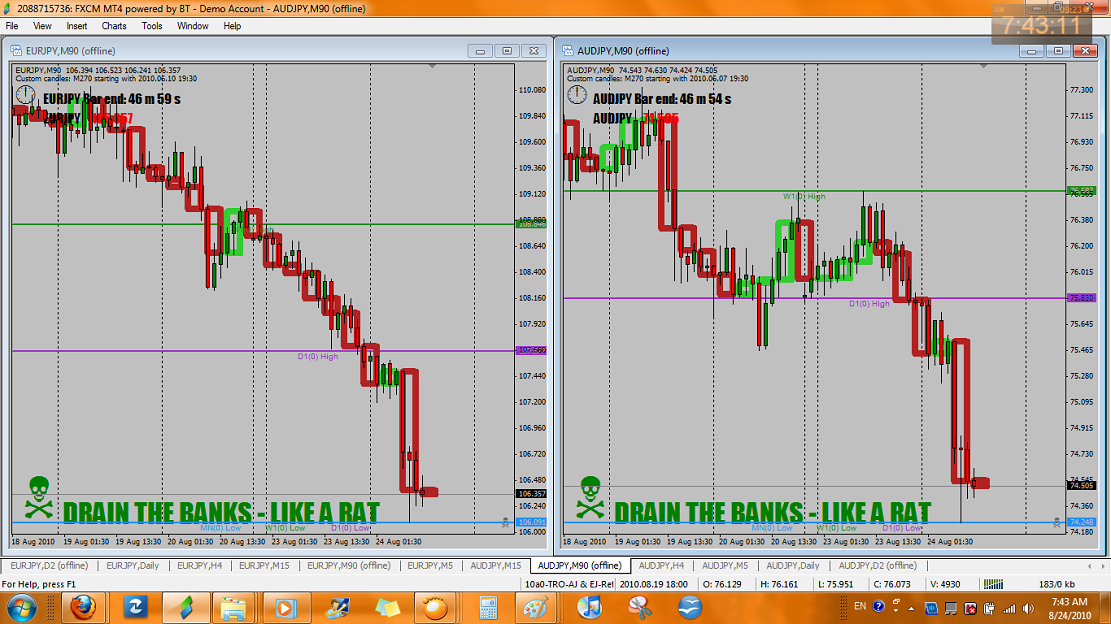

As you can see, trying to get a long-term, Long position was a dismal bias for the last few days.

M90:

H4:

If looking to go long, it all starts with green paint closing higher than something.

With all that red paint on your charts, you would short the high extremes if your position on the larger charts looked good to you.

DAILY, WEEKLY, MONTHLY, YEARLY...

Did price close above or below something last on these large charts?

That is the direction you are heading in.

[highlight=darkred][font=lucida console]If you have to look beyond center screen for price action then you are better off moving to a higher chart.[/font][/highlight]

H3, H6, H8, D1:

Thanks for the thoughts, MO

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

It seems like it was just the other daythat I was telling myself that Fridays don't have much opportunity...

D1:

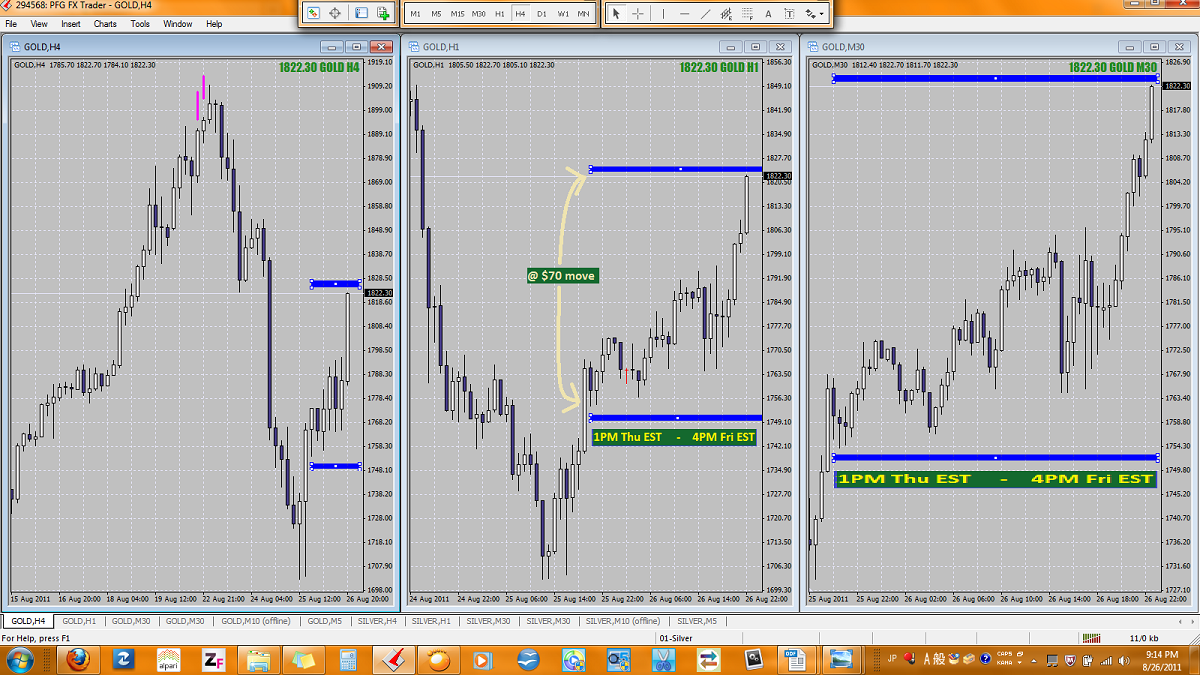

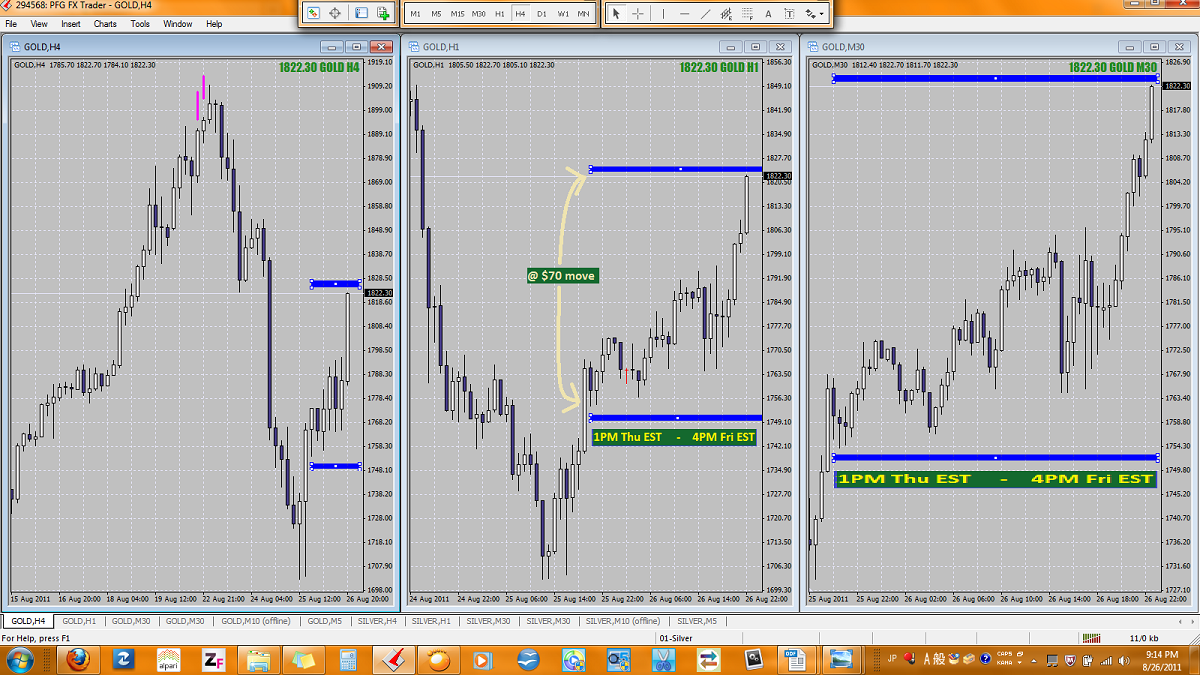

H4, H1, M30:

M30, M10:

Other than that, studying the PA of Gold at ALL TIME HIGHS is quite the learning experience indeed!

(...and a bit of checking out how Silver moves during these interesting times as well...)

D1:

H4, H1, M30:

M30, M10:

Other than that, studying the PA of Gold at ALL TIME HIGHS is quite the learning experience indeed!

(...and a bit of checking out how Silver moves during these interesting times as well...)

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

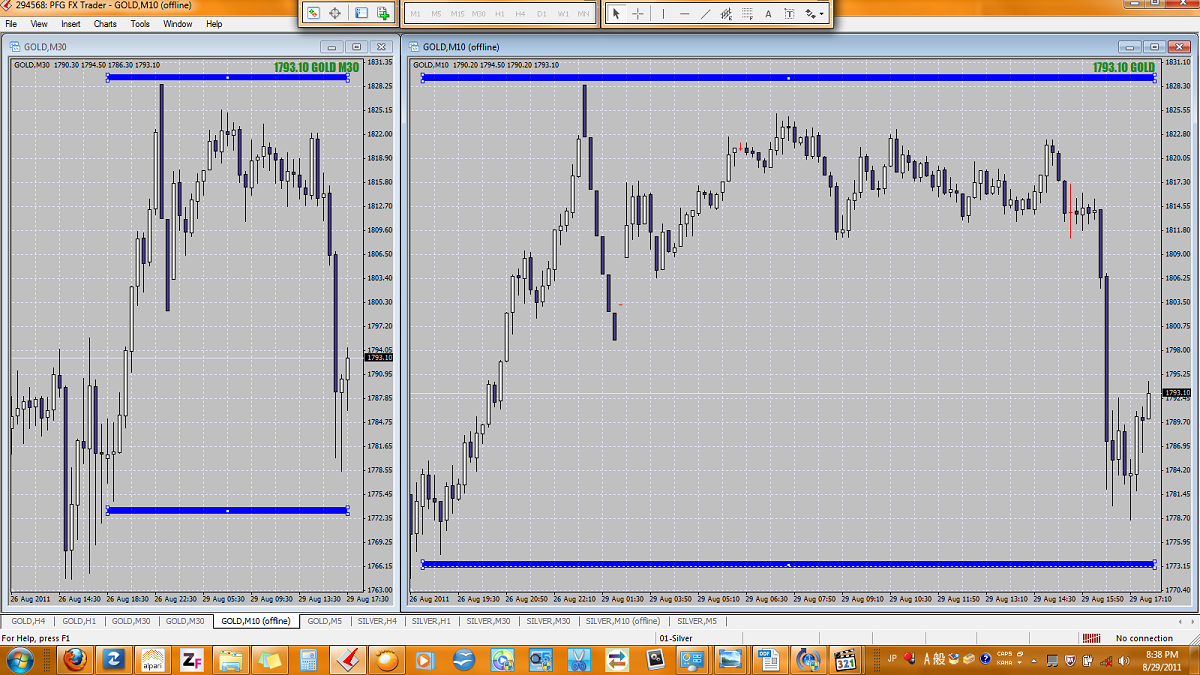

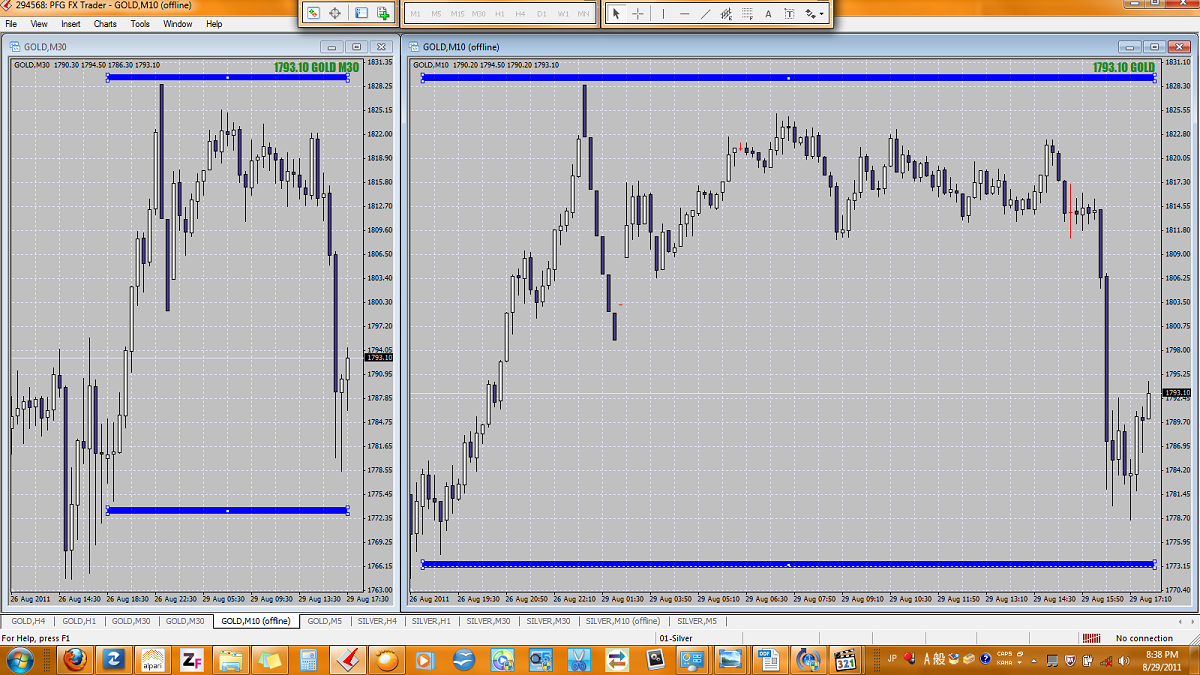

[highlight=darkgreen]MORE Price Action as expressed by Mass Psychology + some Institutionalized trickery...[/highlight]

(FYI- the blue lines just help me to keep track of time across the different charts more quickly, I'm not marking out any zones or anything.)

Gold & Silver; H4, H1, M30

Gold & Silver; M30, M10

(FYI- the blue lines just help me to keep track of time across the different charts more quickly, I'm not marking out any zones or anything.)

Gold & Silver; H4, H1, M30

Gold & Silver; M30, M10

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

[highlight=darkred][font=lucida console]Body in the direction of profit, wick in the direction of loss; if price has been closing higher then what makes you think that it will close lower?[/font][/highlight]

Yeah, I'm gonna have some trouble wit this one it seems.

Here is a great trade I made tho, entered Long Sunday night before bed. Got to work and saw how well it worked out.

Exited because 7% on a trade was good enough for me; that and something about exiting after a burst momentum on H1 (so I didn't even bother to wait and see what the M20 was gonna tell me.)

Entry based on: Trade long above the close of MOMO like it was your sitdown line.

http://kreslik.com/forums/viewtopic.php?p=16997#16997

http://kreslik.com/forums/viewtopic.php?p=17002#17002

Additionally, I would've hated it if I made this SAME mistake again. (i.e. not wanting to trade in the same direction after seeing so many consecutive candles.)

EChf Long (@ 150pips)

M5 at time of entry:

Yeah, I'm gonna have some trouble wit this one it seems.

Here is a great trade I made tho, entered Long Sunday night before bed. Got to work and saw how well it worked out.

Exited because 7% on a trade was good enough for me; that and something about exiting after a burst momentum on H1 (so I didn't even bother to wait and see what the M20 was gonna tell me.)

Entry based on: Trade long above the close of MOMO like it was your sitdown line.

http://kreslik.com/forums/viewtopic.php?p=16997#16997

http://kreslik.com/forums/viewtopic.php?p=17002#17002

Additionally, I would've hated it if I made this SAME mistake again. (i.e. not wanting to trade in the same direction after seeing so many consecutive candles.)

EChf Long (@ 150pips)

M5 at time of entry:

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

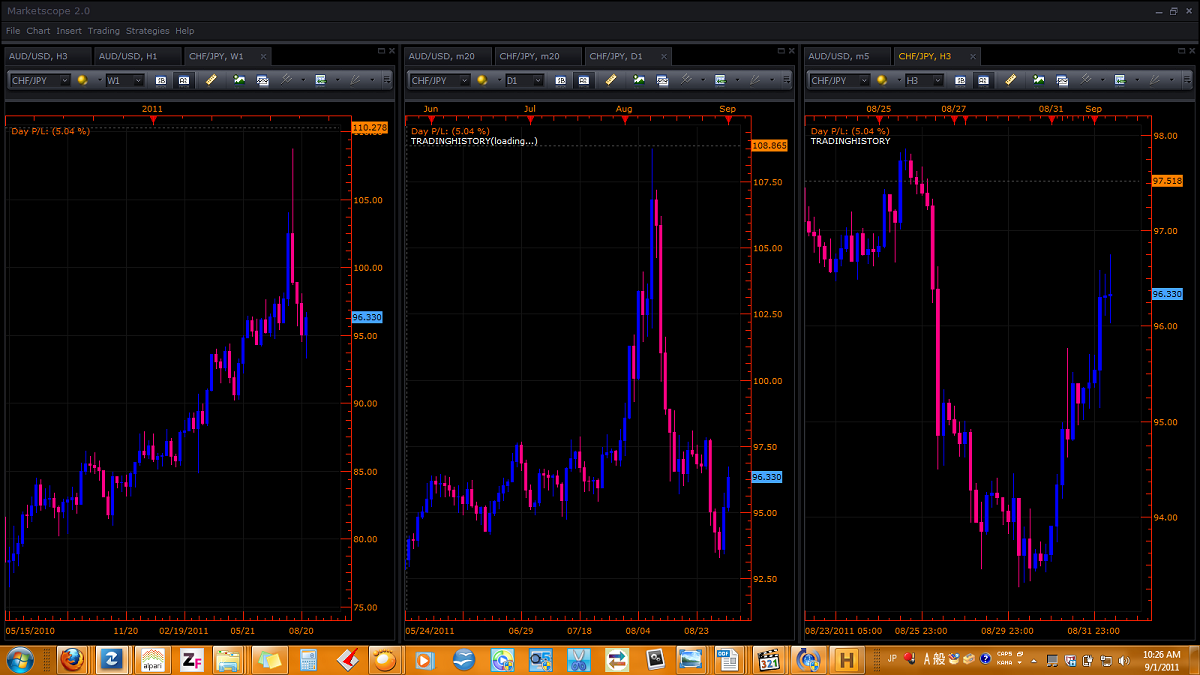

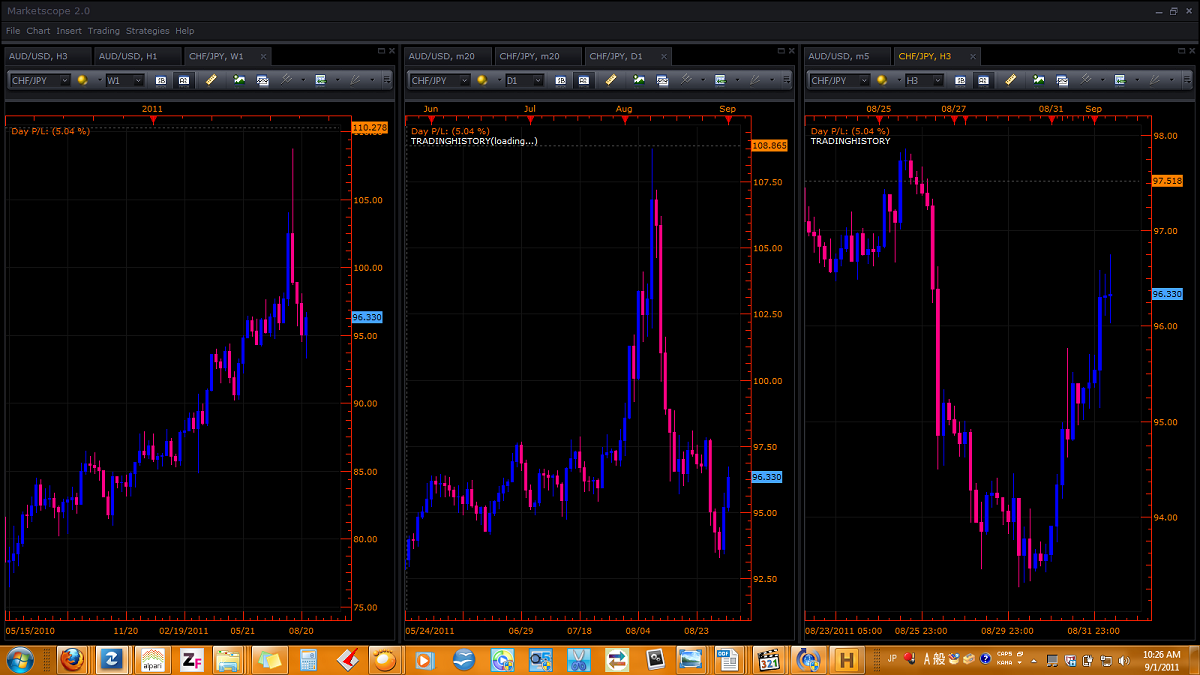

OBSERVATION, ChfJ, 09-01-11

ChfJ looks ripe for a short...

Unfortunately, I'm already in UCad short at 40:1 leverage

That's pretty kamikaze for me

...and I'm doing it pretty recklessly, I might add

ChfJ ~ W1, D1, H3:

Unfortunately, I'm already in UCad short at 40:1 leverage

That's pretty kamikaze for me

...and I'm doing it pretty recklessly, I might add

ChfJ ~ W1, D1, H3:

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

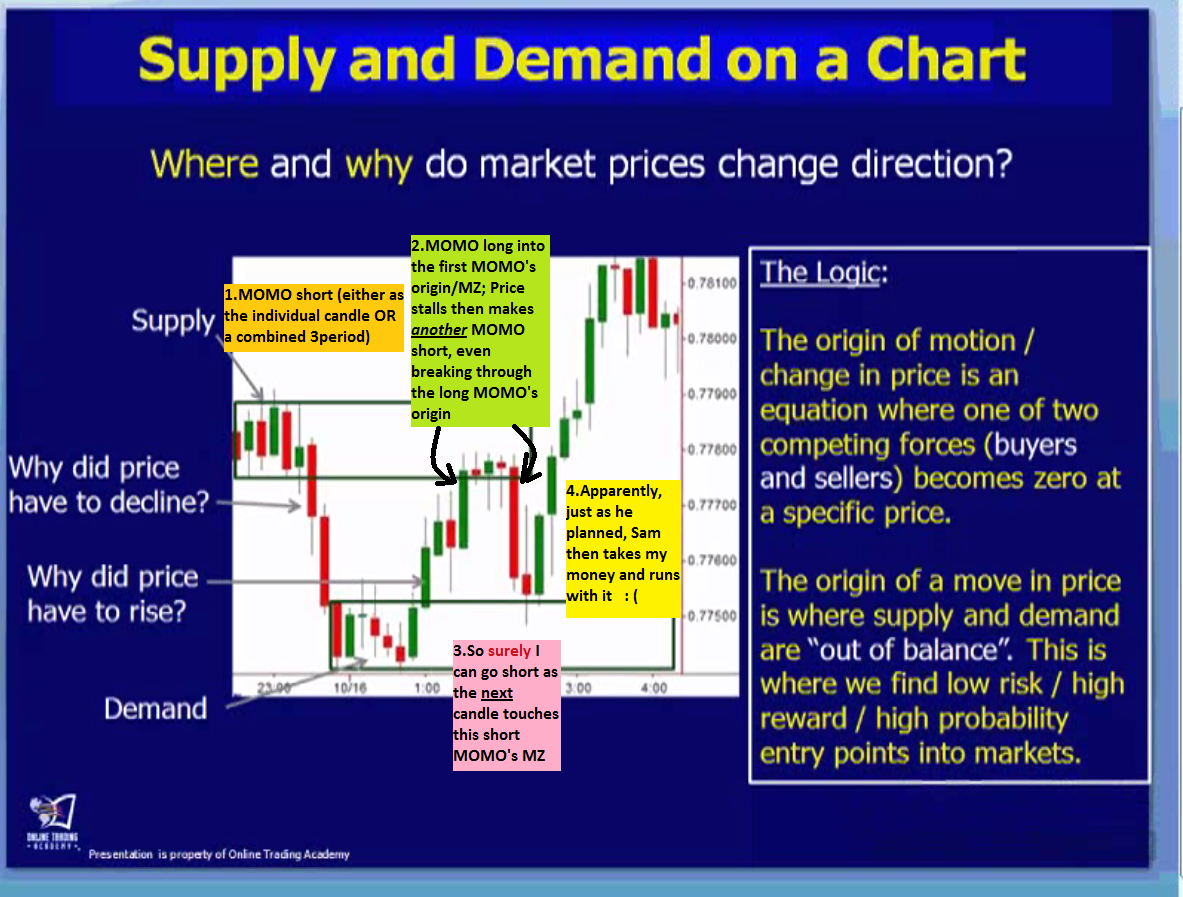

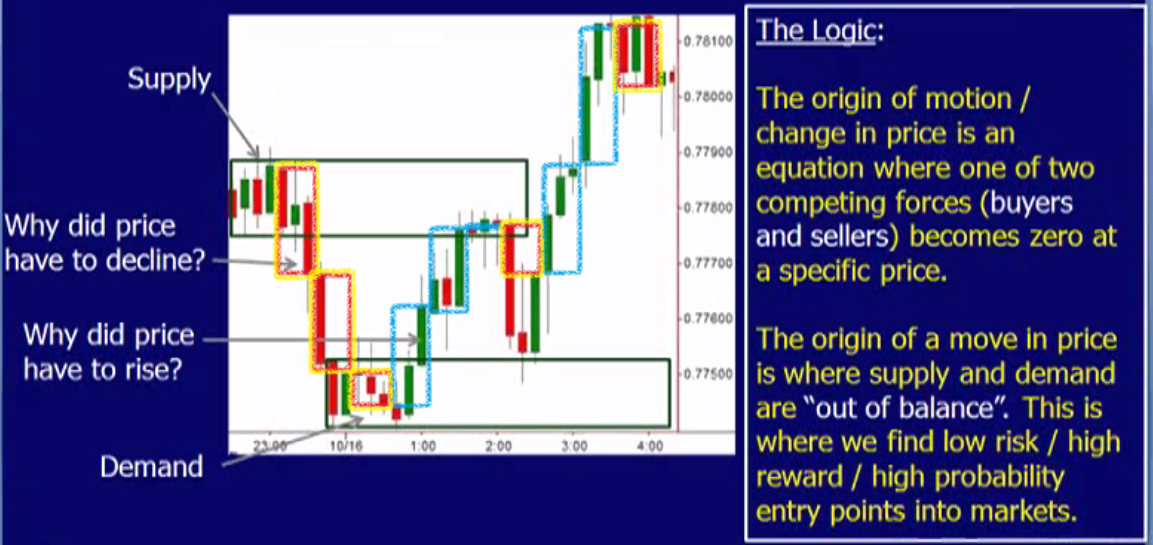

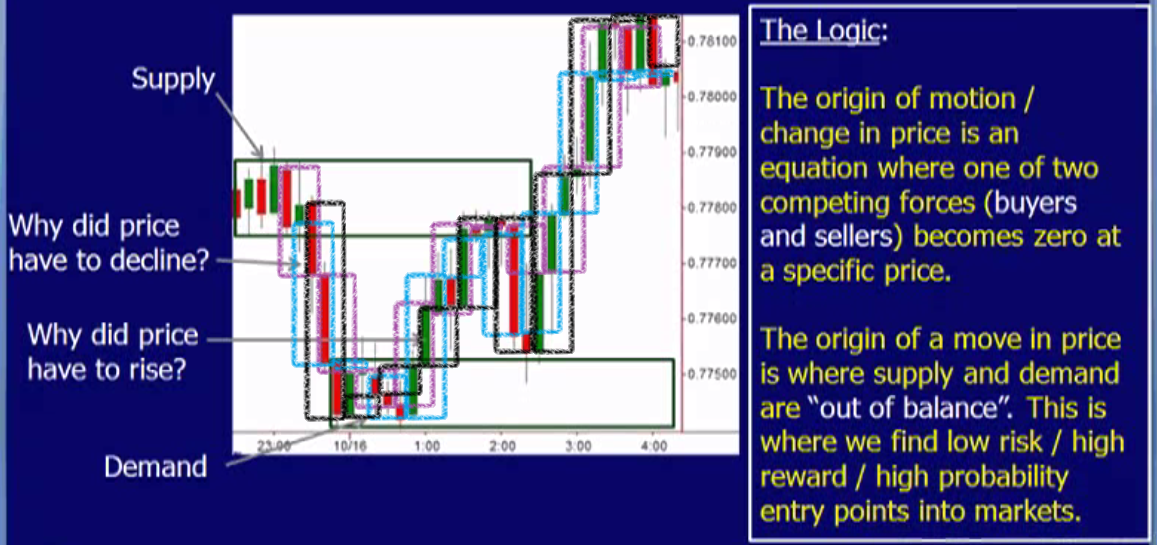

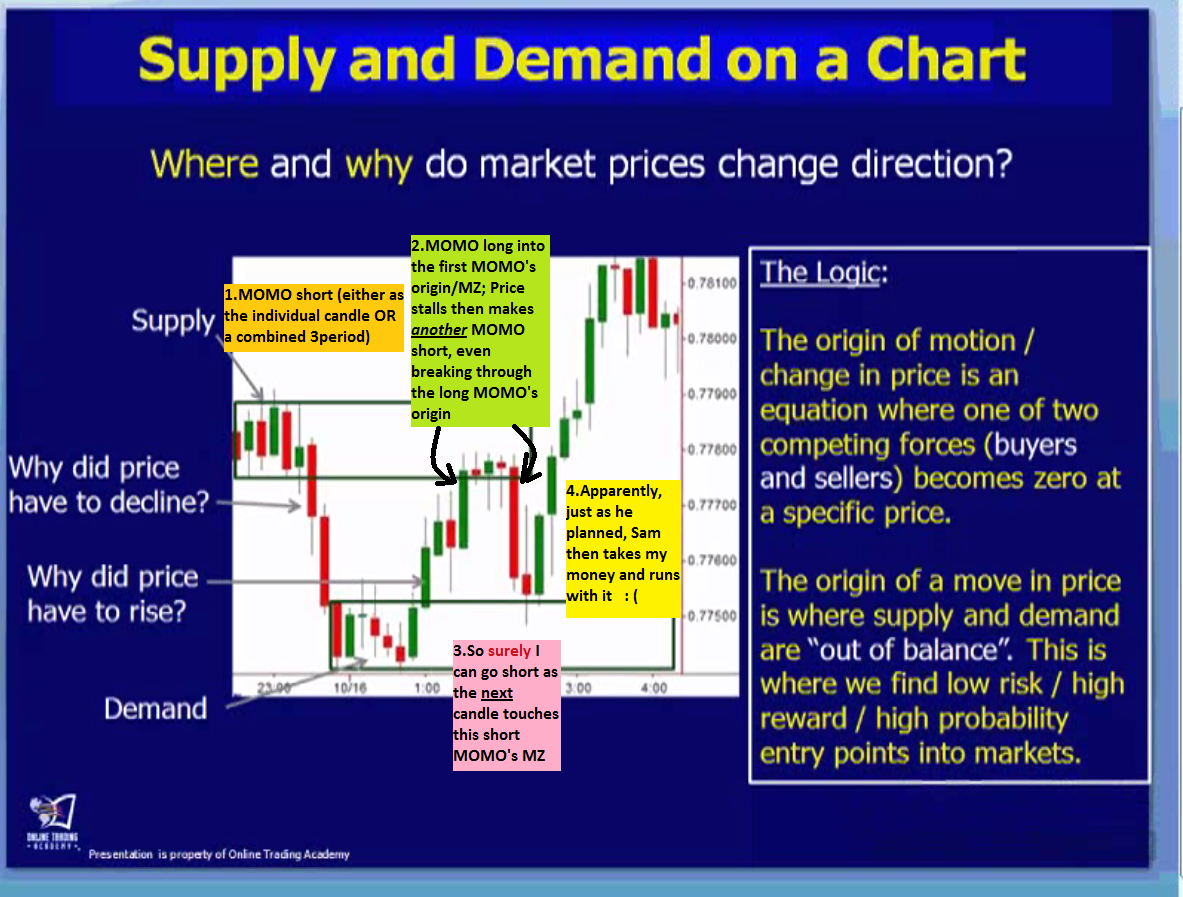

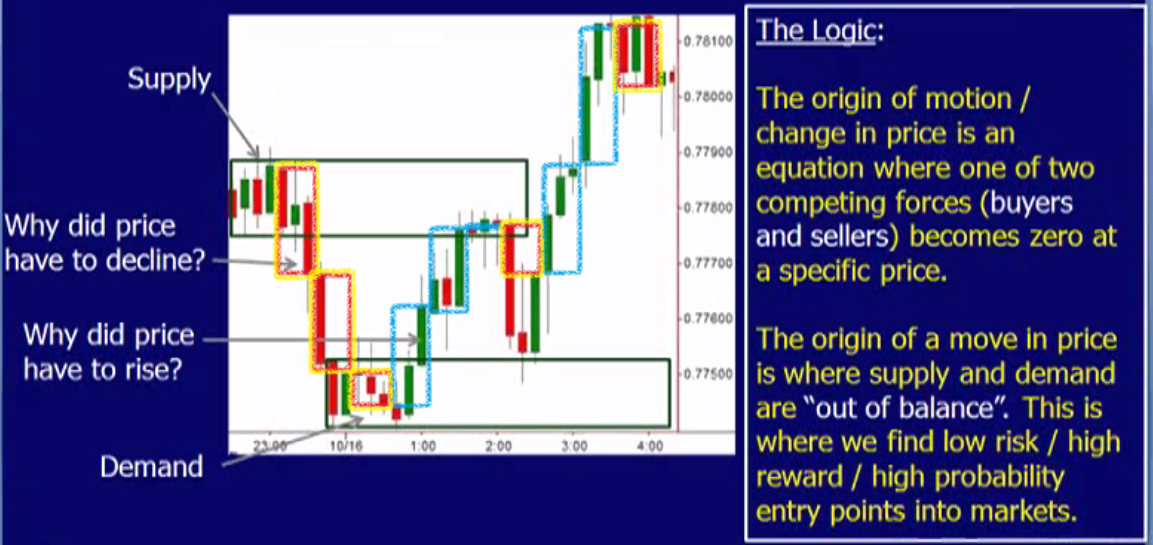

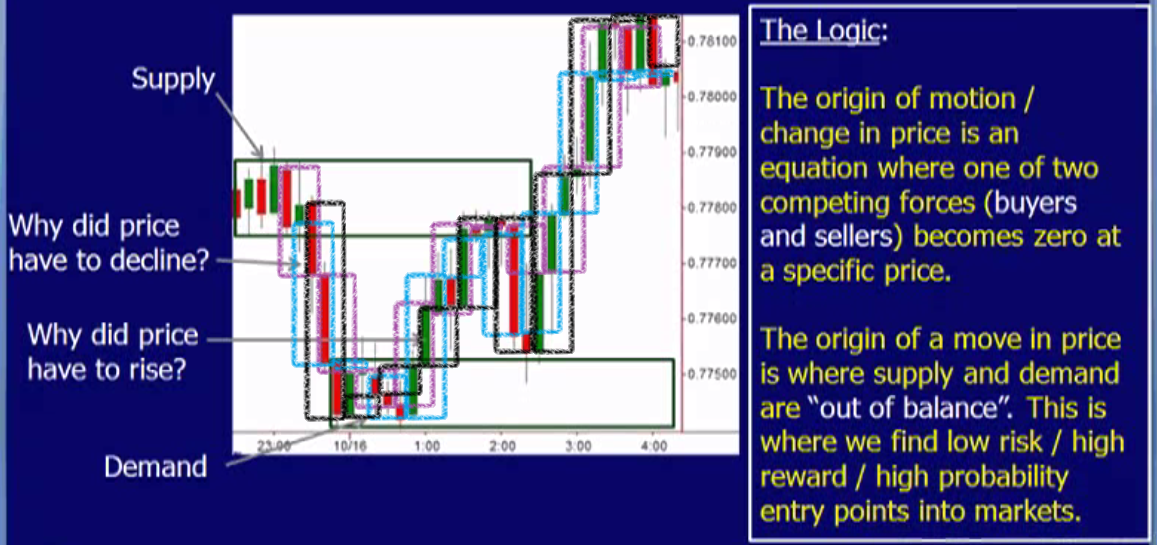

Watching Sam Seiden again...

So this is my busy season at work and since I'm too busy to have my mind focused to trade, instead I've been watching Sam Seiden video's again.

I must've watched at least 15hours of webinars from the comfort of my office desk this week.

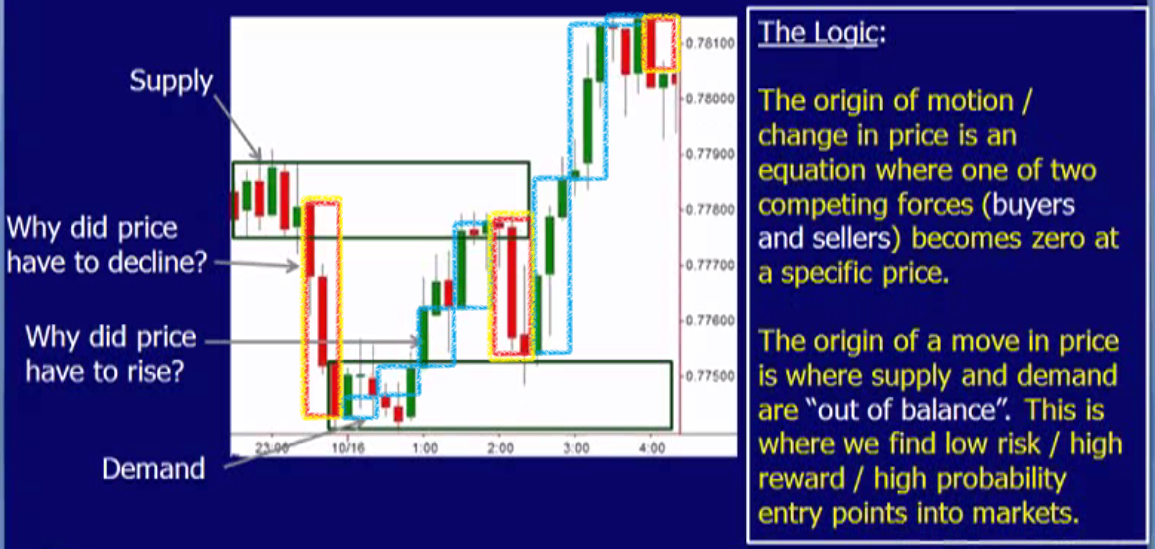

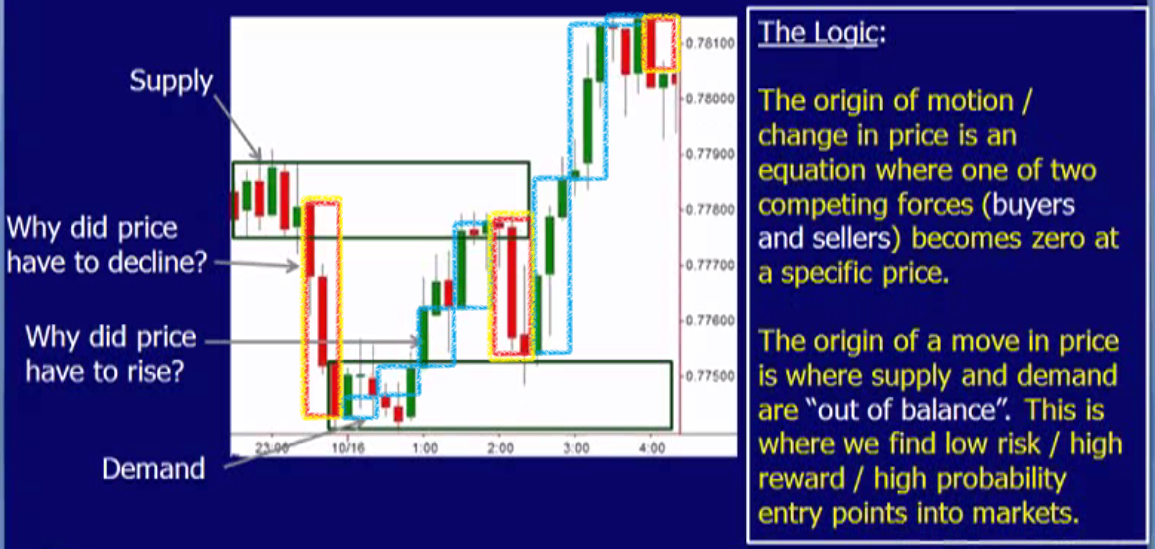

So he puts up this slide of what a good trade setup for him is (according to his views of supply and demand), and in fact it WAS a trade that he took.

I realize it's a frustrating trade situation where I would've (and probably usually) placed the losing trade. Granted, he DOES say that nothing is 100% guaranteed with his entries, but the fact that he chose to put this chart up in his presentation as an ideal situation means a lot.

And so I started thinking...

10min chart, BTW; also he has already defined the area as a Demand Zone (i.e. good for longs) in the higher timeframe context.

This is how I usually approach the situation:

So then I tried to analyze the situation further:

I even tried to 3xCC the area

(here I switched up a color in case that makes it easier for you to read)

I haven't studied 3xCC at all up to this point, so I ask a favor if one of you guys could tell me what the leading CC is in this area. Also, even nicer would be if you could 'talk' me through how you are reading the CC for this small snippet of a chart.

I'd rather not lose anymore to Sam and his simple setup.

But seriously I like to watch his stuff b/c he has a proven track record with his purely Price Action Method. His method seems to look for a lot of the same things we look for. I guess I wonder if I can separate what makes his entry/exit choices different than 'ours', it might could help me filter out which entries/targets I should aim for. (For example, if I think he has an entry opposite of me, then I should go for a smaller target in that case...instead of letting price get to him, and then he runs me over with it.)

I must've watched at least 15hours of webinars from the comfort of my office desk this week.

So he puts up this slide of what a good trade setup for him is (according to his views of supply and demand), and in fact it WAS a trade that he took.

I realize it's a frustrating trade situation where I would've (and probably usually) placed the losing trade. Granted, he DOES say that nothing is 100% guaranteed with his entries, but the fact that he chose to put this chart up in his presentation as an ideal situation means a lot.

And so I started thinking...

10min chart, BTW; also he has already defined the area as a Demand Zone (i.e. good for longs) in the higher timeframe context.

This is how I usually approach the situation:

So then I tried to analyze the situation further:

I even tried to 3xCC the area

(here I switched up a color in case that makes it easier for you to read)

I haven't studied 3xCC at all up to this point, so I ask a favor if one of you guys could tell me what the leading CC is in this area. Also, even nicer would be if you could 'talk' me through how you are reading the CC for this small snippet of a chart.

I'd rather not lose anymore to Sam and his simple setup.

But seriously I like to watch his stuff b/c he has a proven track record with his purely Price Action Method. His method seems to look for a lot of the same things we look for. I guess I wonder if I can separate what makes his entry/exit choices different than 'ours', it might could help me filter out which entries/targets I should aim for. (For example, if I think he has an entry opposite of me, then I should go for a smaller target in that case...instead of letting price get to him, and then he runs me over with it.)

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.